In my capacity as a member of the FIX Protocol Limited working group on electrical energy pricing (now inactive) I attended the FPL EMEA Trading Conference at Old Billingsgate in London on Thursday. The keynote speaker at the event was Andrew Neil. Publisher, writer and broadcaster according to the delegate guide. As you might expect Andrew had many insightful and/or amusing things to say about the current state of the global economy in general, and the no longer AAA British economy in particular. It’s probably not much consolation to most of my readers when I say that he was far more optimistic about prospects for the United States than for the United Kingdom and Europe. I’ve been waiting for someone to post a comprehensive overview of Andrew’s musings, but nobody seems to have done so as yet, so it looks as though I will have to pick up the baton. It’s a tough job, but someone’s got to do it!

Neil Ainger over at bobsguide has briefly covered the first part of Andrew Neil’s speech, but for some reason neglects to mention the considerable amount of time he spent offering his different prognoses regarding the future energy security of us over here in Europe compared to our cousins over in the United States. According to Neil:

In his opening speech, Neil [the other one] outlined the UK and European economic and political situation for the audience of traders, investors, technologists and financial market participants, warning that loose monetary policy in the UK has the potential to incubate a low wage, high inflation economy. In recent years, wage rises have not kept pace with the cost of living in the UK, depressing demand and creating a downward economic cycle in the country.

You get the idea! Please feel free to read the rest of Neil’s article should you feel the need to experience a pain in all the diodes down your left side. My ears really pricked up however, when Andrew start talking about what he described as an imminent “major geopolitical change” based upon the much improved outlook for United States energy security. He thought that the exploitation of large deposits of shale oil in North Dakota will, almost literally, change the world overnight:

When Mr. Obama was re-elected for a second term in November 2012 only 10% of US oil was imported from the Middle East. When he leaves office not a single drop of oil will come from the Middle East.

Mr. Neil predicted that in the comparatively near future the US will actually become a net exporter of both Liquified Natural Gas and oil. Consequently Mr. Obama would become “the first Pacific President”, and the United States’ strategic interests and military muscle would move away from Europe, the Middle East and Africa (EMEA for short) towards a “Pan Pacific Pact“. As Mr. Neil put it:

Once that has happened who will keep the Strait of Hormuz open if not the Americans. Even the Chinese cannot do it. They don’t have enough planes.

With that sobering thought still ringing in our ears, Andrew offered to take a few questions from the floor. I waved my arm hopefully in the air, and was the second lucky recipient of the precious microphone. After announcing my name and affiliation I continued as follows:

You’ve already answered most of the questions I had about energy policy, but I do have a couple of supplementary questions. Tar sands, Keystone XL, renewables in the US and renewables in Europe?

Mr. Neil seemed convinced that both gas and oil would be flowing towards the Gulf of Mexico for export in significant quantities. However he didn’t seem optimistic that “windmills” as he called them would save our bacon over on this side of the Atlantic Ocean. I still had hold of the mic at that point, and took the opportunity to gently point out that the correct terminology is “wind turbines”. According to Mr.Neil renewable energy in general, and wind in particular, is far too variable to ever be more than a peripheral supplier of electrical energy, either in Europe or the United States.

By this time I had already handed the microphone back, so I had to bite my tongue while Andrew answered another question or two. After a well deserved round of applause he sat down. At this point I stood up, jumped onto the podium, handed him my business card and suggested he get in touch at a more convenient time.

Here’s the thing. If Andrew knows anything about what the FPL EEP working group got up to, or what the rest of the United States smart grid working groups and committees are endeavouring to achieve, he gave a very good impersonation of someone who hasn’t got a clue.

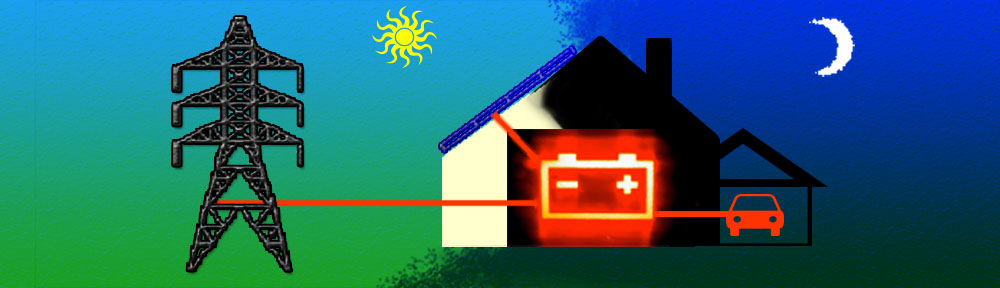

Mr. Neil seemed to be similarly unaware that no less an authority than George Osborne recently suggested that low cost energy storage is vital to the UK’s future economic well being. As George succinctly put it last year:

Electricity demand peaks at around 60 GW, whilst we have a grid capacity of around 80 GW – but storage capacity of around just 3 GW. Greater capability to store electricity is crucial for [renewable] power sources to be viable. It promises savings on UK energy spend of up to £10 billion a year by 2050 as extra capacity for peak load is less necessary.

A great post as usual… thank you for all the info and the inside reports