That’s a question I’ve been wondering about since UK retail electricity prices started rising and suppliers started going bust in droves. And I am not the only one. Here’s Enel CEO Francesco Starace speaking to CNBC back in the summer:

If you look at Europe this [electricity price spike] was quite easy to predict. 2021 is the first year in which the ETS (Emissions Trading Scheme) gets into this mechanism of cutting quotas as the slack shows up, and that’s working, and I think that is something that everyone was expecting to work and it’s doing the job. The question is whether this will become too much, or whether politicians will be able to understand that they have to be part of this game, and use fiscal levers to mitigate the impact on the most vulnerable customers.

No doubt there are also other factors at work, but one way and another we here in the

United Kingdom seem be losing “this game” by many a mile at the moment.

Those “most vulnerable customers” are currently feeling the impact, as indeed are we when perusing our own electricity bills. I’ve been documenting that impact via videos of our own local friendly neighbourhood wind turbine at Upper Tremail when the wind is blowing, thanks to both Storm Arwen:

and then 10 days later thanks to Storm Barra:

I recorded another such video earlier today, when the wind was allegedly not blowing!

As Octopus Energy CEO Greg Jackson put it in response to one of my earlier Twitter threads:

Skipping forward to 3:38 in the video Francesco adds:

It’s very much in the hands of Governments and regulators to mitigate these short term spikes, and to have long term pricing signals into the market in Europe as fast as possible.

Here are today’s “short term pricing signals” across the north west corner of Europe:

As our Twitter “baby bio” has been saying for many years:

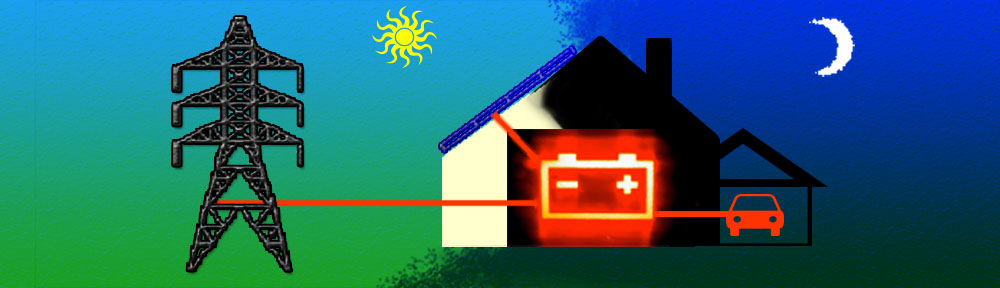

A friendly local neighbourhood energy market would also be nice!

News from Moscow concerning one of the “other factors at work”:

Plus NordPool 18:00 day ahead prices:

According to Bloomberg relief from high gas prices is on the way to Europe: